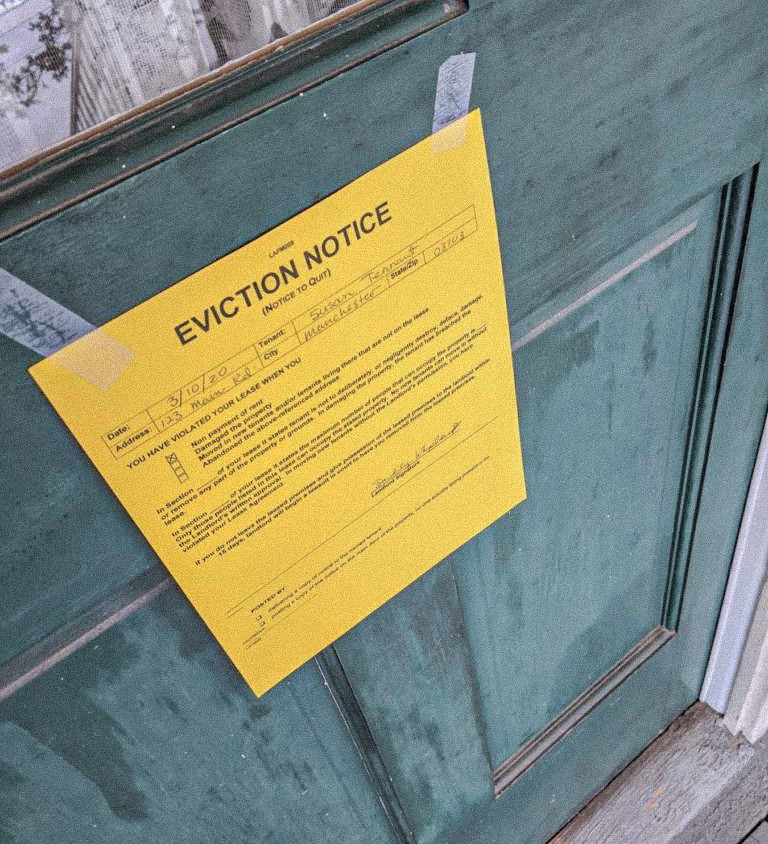

For many Bitcoiners, protecting your wealth starts with moving your coins off centralized exchanges. But real security goes far beyond cold storage. What about your home? Your investments? Your vehicles, your fiat, your business? If they’re still in your name, they’re still on the system’s rails—exposed, vulnerable, and available for the taking.

This is where real asset protection begins.

The Problem With Traditional Asset Protection

Most trust structures available today are rooted in statutory systems—systems governed by fiat law, reliant on fiat currency, and enforceable by the very institutions many of us are trying to exit. Attorneys draft their trusts using USD as the seed money, within jurisdictions that operate entirely inside the public realm. The result? A structure that looks private but is still very much within reach of courts, creditors, and government overreach.

If that feels backward to you, you’re not alone. It felt that way to us, too. And we decided to do something about it.

Settled in Satoshis — Literally Built on Bitcoin

Here’s where things change. Unlike conventional trusts, our trusts are settled in satoshis—not dollars, not precious metals, not promissory notes. This matters for one crucial reason:

Bitcoin isn’t recognized as money by the federal government.

And because it isn’t, a trust settled in sats cannot be easily adjudicated under their monetary laws.

We’ve seen this playbook before. It’s why certain old-world trusts were settled in silver, which, like Bitcoin today, was not considered legal tender. That separation from the fiat system made them untouchable. We’ve modernized that same principle—only now, it’s built on the blockchain.

Sats become the keystone. Not only is your trust decentralized in value, it’s also uncorrelated, censorship-resistant, and secured outside the system. It’s the true cold storage of your real-world assets.

Domiciled in El Salvador — The Legal Home of Bitcoin

We take it one step further: your trust is domiciled in El Salvador, the first nation to recognize Bitcoin as legal tender and build a regulatory framework to support it. For now, this is the holy ground for Bitcoiners. El Zonte, the birthplace of Bitcoin Beach, is the spiritual and legal home base for this movement.

Domiciling your trust here adds another layer of insulation. You’re operating in a jurisdiction that respects your convictions, rather than fighting them. Combine that with a trust settled in Bitcoin, and you’ve created a structure that not only protects your assets—but reflects your values.

This Isn’t Just Strategy—It’s Belief

We didn’t come up with this because it sounded cool. We built it because we’re Bitcoiners too.

We’ve walked through the fire. We’ve studied the law. We’ve tested what works and burned down what doesn’t. And we know what it takes to live privately, securely, and with conviction in a world designed to strip those things from you.

So yes, the future of asset protection is built on Bitcoin—not just in theory, but in code, contract, and jurisdiction.

And if you’ve gone all-in on sound money, maybe it’s time to go all-in on sound protection too.