Your Bitcoin Might Be Safe—But What About Everything Else?

You’ve split your keys across continents.

You’ve gone multi-sig, air-gapped, and got your passphrases locked away.

You’ve studied opsec, used burner phones, and maybe even hosted your own node.

Your Bitcoin is off the exchange—cold and secure.

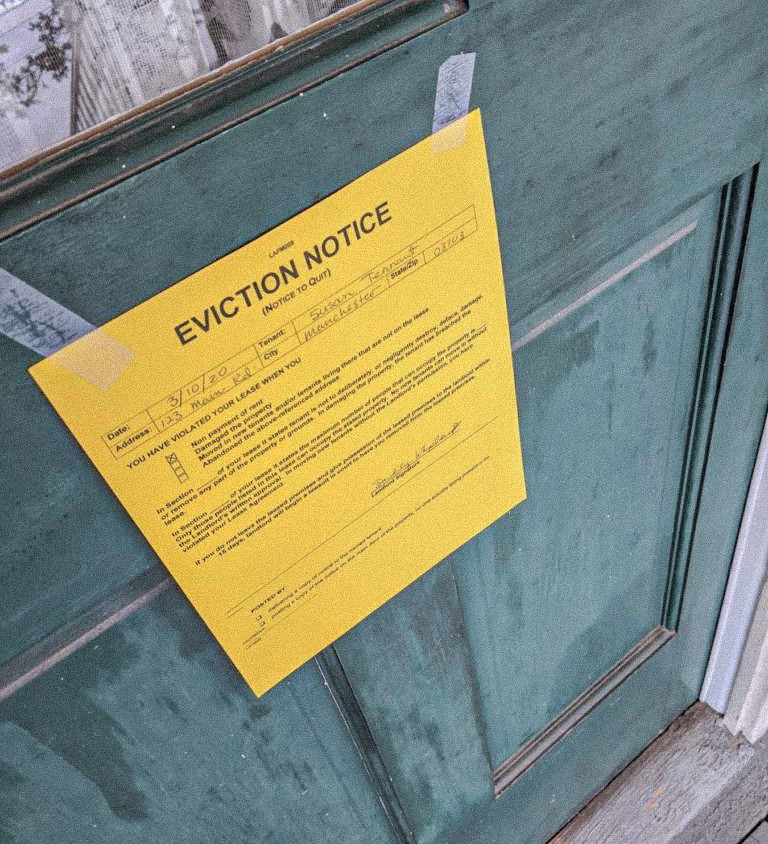

But your house?

Your car?

Your cabin, your boat, your business income, your vacation home?

Still sitting there.

In your name.

On the record.

Low-hanging fruit for any bad actor, bureaucrat, or bloodthirsty attorney looking to make a name—or a paycheck.

A Trust Is Just the Beginning

Yes, trusts are powerful.

Yes, we believe they’re the most effective cold-storage vehicle for real-world assets. But just like Bitcoin, setting one up is only the first step.

After you cold-store your assets, you have to stay cold.

Because what good is a vault if you leave the door open?

This Is Where Most People—Even Trust Owners—Get It Wrong

We see this all the time:

Someone sets up a trust—maybe even a statutory one from a well-meaning attorney—and

they think the work is done.

But here’s the truth:

- If you blur the lines between your personal life and your trust, it can be pierced

- If you transact sloppily, treat trust assets like personal ones, or mix public and private, you’re

vulnerable - If you don’t understand the contracts you’re signing or the benefits you’re receiving, you

could be giving the system a backdoor into your estate

Think of it like exposing your cold wallet keys:

Would you ever hand them over to a third-party custodian without multi-sig?

Then why expose your trust?

The System Will Always Protect Itself—Not You

Don’t be fooled by the system playing nice.

One day, it says it’s pro-privacy or pro-Bitcoin.

The next, it invents a new statute or policy.

Why? Because their paycheck depends on it. Their power thrives on your exposure

They are glorified administrators with a badge and a budget—and they write the rules as they go.

You must know how to:

- Maintain operational integrity in your trust

- Avoid triggering public scrutiny through mixed-use

- Keep your private contracts truly private

- Understand when and how the public and private worlds intersect

Your Trust Is Only as Strong as Its Steward

Just like a cold wallet, a trust doesn’t protect you if you handle it carelessly.

A pierced trust is no better than no trust at all.

That’s why our training doesn’t stop with paperwork.

We show you how to:

- Operate inside the system without compromising your values

- Walk in honor, not fear

- Maintain strict boundaries to avoid exposure

- Layer your privacy protections like a multi-sig vault

Because it’s not just about hiding your assets—it’s about preserving your legacy.

The future will reward those who prepare.

Not just with paperwork, but with wisdom.

We’re building more than privacy—we’re building generational protection.

There’s More Where That Came From

We’ve only scratched the surface.

The path to living privately—and staying there—has many layers.

In upcoming articles and trainings, we’ll cover:

- How to keep your trust from becoming a liability

- Navigating adhesion contracts and hidden consent traps

- Structuring lifestyle expenses while remaining private

- Case studies from clients who’ve faced and fought exposure

If your assets are worth protecting, your legacy is worth guarding.

You’ve already exited the fiat game—now learn how to exit the exposure that comes with it.

Let us show you how.