Why Keeping Assets in Your Name Is Like Leaving Bitcoin on an Exchange

If you’ve been around Bitcoin long enough, you’ve probably said it—or tattooed it on your soul: “Not your keys, not your coins.” It’s the first rule of Bitcoin. If your BTC sits on a public exchange, it’s not truly yours. It’s exposed. Vulnerable. Subject to seizure, policy changes, hacks, or flat-out disappearance.

But what about the rest of your life?

You Took Your Coins Off the Exchange…

Now What About Your House?

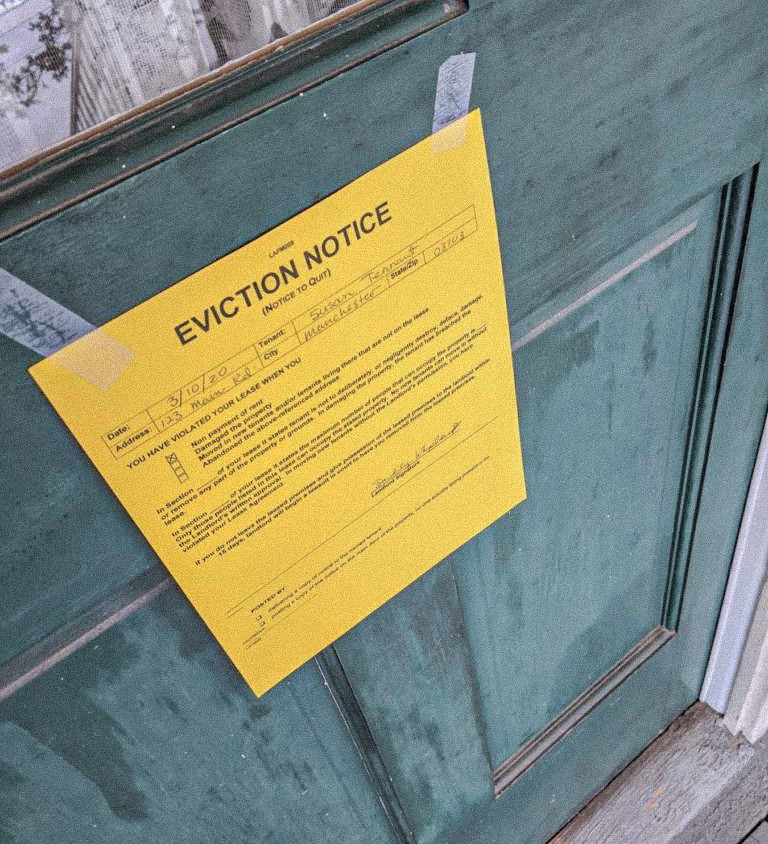

A surprising number of Bitcoiners who’ve nailed the art of self-custody continue to leave their most valuable real-world assets out in the open. That new house you just bought? Registere in your name. Your dream car? Personal plates and all. Vacation home? It’s tied directly to your personal identity and SSN. That bank account holding a six-figure fiat buffer? In your name, on their rails, and fully visible.

You wouldn’t store 25 BTC on Coinbase…

So why are you storing your life on the public record?

The Lie of Ownership (And the Cost of Pride)

We get it. You’ve worked hard. You want to celebrate success. You’ve dreamed about that car or that house or that flex. And hey, no one’s here to judge you for winning. But if your name is on it—registered with the state, cataloged by financial institutions, tracked by data brokers— you don’t own it in the way you think.

You own the liability.

You’ve placed a target on your back—an access point for lawsuits, creditors, tax liens, and asset-hungry bureaucrats. It’s like writing your seed phrase on a whiteboard in a co-working space. Proud? Sure. But dangerously exposed

The Bank Account Trap

Most people don’t realize how fragile the fiat system has become. We’re already seeing warning signs:

- Bail-ins quietly passed into law

- Account freezes with no warning

- Daily withdrawal limits

- Opaque bank “holidays” and internal closures

Keeping large sums in your personal checking or savings account? That’s not security—it’s nwishful thinking. And just like exchanges, banks don’t work for you. They work for themselves. And their rules can change overnight.

Real Privacy = Invisible Ownership

What if your home wasn’t in your name—but you still lived there?

What if your car wasn’t tied to your ID—but you still drove it every day?

What if your money didn’t touch your personal accounts—but you still accessed it with

freedom and peace of mind?

This is the difference between exposure and protection. Between illusion and control. Between being known by the system—and being off its radar entirely.

Through the use of private, irrevocable trusts, you can remove the liability while still enjoying full access. You gain use, without ownership. You live free, while remaining hidden.

Would You Ever Post Your Cold Wallet Balance Online?

Didn’t think so.

Then why are you broadcasting your life’s assets with every property deed, DMV record, bank account, and investment portfolio in your name? This is the digital equivalent of handing out your seed phrase at a Bitcoin conference.

It’s time to cover your ass(ets).

Hide what matters. Lock it down. Keep the public out

Final Thought: The Real Flex Is Privacy

The world’s changing fast. Asset protection isn’t just for the ultra-wealthy anymore—it’s for anyone who’s done playing their game. You’ve cold-stored your Bitcoin. Now it’s time to cold-store your life.

At Orange Effect, we help you take the same philosophy you use with your money, and apply it to everything else. Because real privacy isn’t loud—it’s silent. And the smartest move you’ll ever make is the one no one ever sees.